DOMAIN

CONTEXT

Finance

Transportation

This contract design role consists of a few different design exercises. First, to redesign the auto-loan application experience for edge use cases - those who do not have SSN. The second part is to merge the DriveInformed’s workflow with a few clients’ branding and visual styles. In addition, I worked on the UX of filter for car inventory after talking to users to understand a first time user perspective.

COMPETITIVE RESEARCH

Asides from CarMax, I looked at popular auto-loan startups and companies including Vroom and Shift for UI and UX flows among other features.

CarMax: CarMax allows customers to change search distance and zip code

Vroom: Vroom by default keeps all filter sections closer to minimize scrolling and keep the design clean.

Shift: Shift not only minimizes scrolling by keeping filters closed but also provides a search bar that shows what filter(s) have been selected.

DESIGN FOR EDGE CASES

I looked at how to design auto-loan application workflow for customers who do not have SSN. By taking a photo of their photo ID and fill in current address, customers can access information regarding what vehicles they qualify even without SSN.

USER RESEARCH

Figuring out what vehicles you are qualified for is a complex process. Customers are eager to fill out the forms quickly, and yet lenders and dealers need to collect abundant information to assess what customers can qualify for. This requires balancing simplifying and retaining.

CONCEPT AND WORKFLOW IDEATION

Options

Assume that users have filled out the pre-qualification form, browser through the inventory and picked out the car they like, but they don’t have SSN to verify the identity.

Loan Application

User will be directed to loan application form designed for their circumstance. In addition to a form, they are asked to submit photo of their ID to substitute for SSN.

Taking a Picture

The user can take a picture of their ID using their phone as a final step to verify their identity before qualifying a loan.

DATA CATEGORIZATION

The next part of the design takes the entire workflow in consideration. I considered multiple channels and sources of data, from personal data, vehicle data, employment and income data that determine the completion of auto-loan process.

I mapped out various channels of data that are needed to qualify for auto-loan.

FINAL SOLUTION

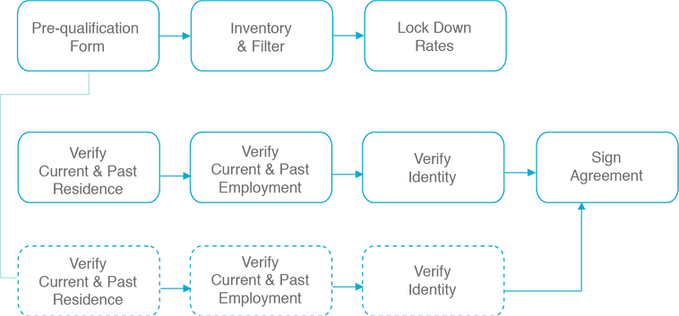

Below is a journey map for user to start an auto-loan process from beginning to end.

DESKTOP DESIGN

Starter Screen

User are presented with illustration and UI that are similar to DriveInformed’s lender customers style, and they fill out a pre-qualification form to get started.

Inventory

Filter helps narrow down the available options.

Congrats

This screen notifies users that they have successfully locked down a rate with different payment options.

Current Residence

In order to lock down the rate, users need to verify current address.

Current Work

In order to lock down the rate, users need to verify current employer.

Verify Identity

The second to last step is to verify one's personal information.

Submit Application

The last step is to sign agreement and submit application.